|

Sindh’s shrinking share in farm credit

Home

By Sabihuddin Ghausi

SINDH is gradually losing its share in agricultural credit

which is being attributed to the limited availability of

farmers’ passbooks, the lack of cooperation by the

provincial revenue departments to verify these books,

issuance of bogus passbooks and closure of the Sindh

Provincial Cooperative Bank.

From

a 21 per cent share in the national credit disbursement in

2000-01, Sindh’s share, dropped to a mere 11 per cent in

2005-06 and bankers are convinced that it has declined 10

per cent in the first half of the current fiscal when

overall credit disbursement is 45 per cent of the officially

fixed target of Rs160 billion. From

a 21 per cent share in the national credit disbursement in

2000-01, Sindh’s share, dropped to a mere 11 per cent in

2005-06 and bankers are convinced that it has declined 10

per cent in the first half of the current fiscal when

overall credit disbursement is 45 per cent of the officially

fixed target of Rs160 billion.

“The enhanced cooperation by the Sindh Revenue Department

and automation of land records in the medium term, could

bring improvement in flow of funds to the sector in the

province,’’ an official document of the federal government

observes declaring that Sindh has immense potential to

attract flow of institutional credit.

The position of Balochistan for attracting credit inflow is

dismal where only 0.4 per cent disbursement was made against

a target of 1.5 per cent growth. Bankers attribute low

agricultural credit demand in Balochistan to continuation of

drought like conditions which caused a slump in recovery,

and hence the problems in sanctioning of new loans and

disbursement.

Agricultural credit disbursement in Pakistan is

characterised by growing regional and provincial

disparities. In July 2005, the Agricultural Credit Advisory

Committee (ACAC) took notice of these disparities and

allocated province-wise targets based on cropped areas to

ensure inflow of adequate flow of institutional credit in

the four provinces.

“Instead of narrowing down these disparities, the new system

has further aggravated the situation as farmers in Punjab

have availed 82 per cent of the total disbursement against

the target of 78 per cent,’’ an official document reveals.

According to this document farmers in Sindh availed 11 per

cent of the proposed 14 per cent increase in agricultural

credit target in 05-06. The NWFP availed 5.3 per cent of the

allocation of six per cent and Balochistan got only 0.4 per

cent credit against 1.5 per cent allocation. The Azad Jammu

and Kashmir and FATA received only 0.3 per cent of

agricultural credit from 0.5 per allocated share.

While agrarian scenario in Sindh, Seraiki belt of Punjab and

Balochistan is dominated by big landlords and sardars, who

manipulate land title record with the active connivance of

the Revenue Department officials to prepare bogus passbooks

in the name of farmers of small land holdings, the vast

tract of agricultural land remains uncultivated.

Big landlords do not pay even one-tenth of due “abiana’’ and

repeated requests made to Sindh Irrigation Minister Nadir

Akmal Leghari to give some information on collection of

water tax failed to bring any response.

In the central Punjab, the land holding is fragmented, and

is owned by those who are well represented in army and in

civil service as well as in private services and business

and hence the central Punjab farmers enjoy all the state

facilities for agriculture and credit. No wonder then

Punjab’s share in cropped area is 72 per cent of the whole

country, 69 per cent in major crops, 71 per cent in

livestock. The Punjab farmer is well supported by its

Revenue Department and has relatively easy access to about

4,000 bank branches network, almost 57 per cent of total

country’s banking system.

“Above all, there is far better recovery of agricultural

loans in Punjab,’’ argued a banker who disclosed that the

Sindh Provincial Cooperative Bank was closed down sometimes

in 1989 because influential “waderas’’ borrowed over one

billion rupees and defaulted on its payment. “The interest

amount far exceeded the principal amount,’’ said a leader of

Sindh farmers. For last several years, the Sindh government

has announced the setting up of a micro finance bank for

farmers but the stories of infamous Mehran Bank and its

links with security agencies and politicians still haunts

the memory of Sindh government officials.

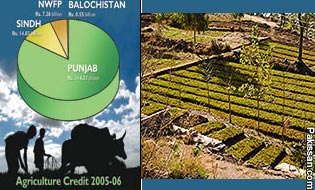

In 2005-06 Sindh’s share in total Rs137 billion agricultural

credit was only Rs14.83 billion (10.79 per cent) ,

Balochsiatan Rs555 million (0.40 per cent), the NWFP Rs7.26

billion and the AJK Rs302 million. Punjab got the lion’s

share of 82 per cent amounting to Rs114.37 billion. Punjab

is the only province to receive Rs857 million corporate farm

loans. There is no demand for this loan in Sindh,

Balochistan and the NWFP.

The last meeting of ACAC on February 13, did express its

concern over the slow tempo of agricultural credit

disbursement but mysteriously remained silent on the growing

regional and provincial disparities. Bankers wonder as to

why the Governor of State Bank of Pakistan, Dr Shamshad

Akhtar, expressed her dissatisfaction over “slow growth’’ of

disbursement of farm loans in the first half of the current

fiscal year when almost 45 per cent of Rs160 billion target

loans have been disbursed and they expect to get

applications for major kharif crops—cotton, sugarcane, rice,

maize etc. in next few weeks.

The SBP Governor was unhappy that only 45 per cent of the

loan target had been achieved and she urged the banks to

“take necessary steps to accelerate the pace of credit

disbursement to the agriculture sector during the coming

months so that full target of Rs160 billion was achieved’’.

“She should have spoken on province-wise agricultural credit

disbursement in last six months,’’ a banker said.

“We have already written to the State Bank of Pakistan of

meeting our loan disbursement target before June,’’ an

official of the United Bank said. The UBL is given a farm

loan disbursement target of Rs12 billion which is 50 per

cent more than that of last year at Rs8 billion. In first

half of the current fiscal, the UBL gave away Rs4.29 billion

as against Rs4.46 billion advanced to farmers in first half

of 05-06, a decline of about four per cent.

“The small decline in loan disbursement is due to some

recovery problems in Balochistan,’’ he explained. But he was

confident that the UBL would disburse loans to cotton

growers and other farmers to achieve Rs12 billion loan

target for the current fiscal year 06-07.

Equally confident was an officer of the Habib Bank that put

up the most dismal performance of farm loan disbursement as

its advances to the farmers in the first half of 06-07 was

19.44 per cent less than loans given in the same period of

last year. No senior officer—President Zakir Mahmood, or the

head of agri department—was available to give any

explanation but a junior officer said that big demand comes

in summer for kharif crops and his bank would hopefully meet

the target of Rs25 billion. By December 2006, the HBL had

offered Rs9 billion loans to the farmers.

All the five major banks were given a target of Rs80 billion

which is 27 per cent more than Rs63 billion target given in

05-06. Out of this target, the five banks advanced Rs34.28

billion in July to December period which is 2.31 per cent

more than that of last year loaning.

Overall, the five banks and other institutions have advanced

Rs71.68 billion to the farmers in the first half of 2006-07

which is 45 per cent of Rs160 billion target. Bankers are

confident of advancing about Rs87 billion to farmers who

will soon be seeking loans for cotton, sugarcane, rice,

maize and few other small crops plus for infrastructure

development of agriculture.

All said and done, bankers in the five top banks and other

private banks are reluctant to offer farm loans mainly

because of the administration problems and recovery issues.

“Unlike the urban borrowers, the rural borrowers are

scattered in vast rural areas and difficult to reach when

recovery time comes,’’ explained a banker who said that

after nationalisation in 1974, the bankers “reluctantly took

up the responsibility of advancing farm loans’’.

Farm loans became a function of secondary importance for the

bankers after government officially patronised consumerism

about three years ago, and banks were asked to finance

purchase of cars, motorcycles, electronic goods and

construction and purchase of houses and flats. The ratio of

personal loans, auto credits and for house purchase is

gradually increasing.

.

Courtesy: The DAWN

|

Pakissan.com;

|